1. Hit the price pain point and cultivate diamonds as an affordable luxury

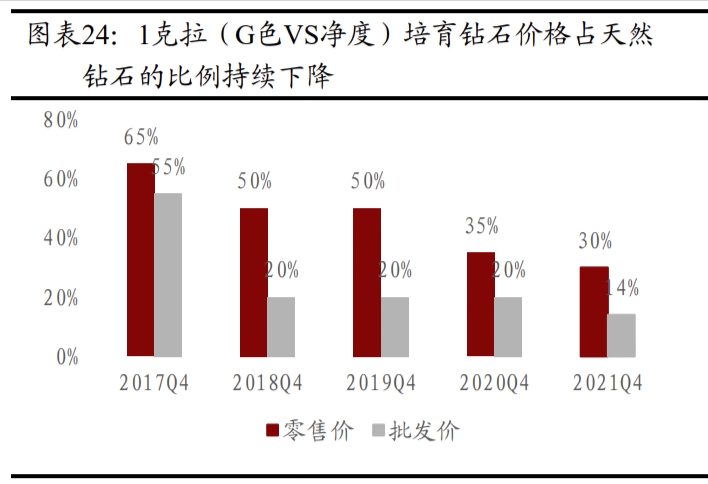

With the upgrading of technology, the price of diamonds continues to decrease, and the high cost performance improves the appeal of consumers. Around 2016, China began to try the small batch production and sales of colorless small particle cultivated diamonds. With the maturity of domestic and foreign technology, the production cost and retail price of cultivated diamonds gradually decreased. According to Bain & Company, the average retail price of cultivated/natural diamond naked diamonds fell from 65% in 2017 to 30% in 2021, while the average wholesale price of cultivated/natural diamond naked diamonds fell from 55% in 2017 to 14% in 2021.

Prices for De Beers' Lightbox, a line of cultivated diamonds, depend solely on weight and style. All lab-made diamonds are priced at $800 per carat, or its Lightbox Finest collection is priced at $1,500 per carat, regardless of the color, clarity or cut of the diamonds sold. Pricing rules are simple. De Beers, who sets the rules for the natural diamond industry, aims to expand its audience with low prices and to provide fast-fashion diamond consumer products aimed at a younger audience. Compared with natural diamonds, the price of cultivated diamonds has a large price advantage, which can seize the existing market share of natural diamonds, attract the price sensitive population with less ability to pay, and push cultivated diamonds further into the fashion category with growth potential.

2. Jewelry brands enter the diamond field and promote consumer education through multi-party publicity

Traditional jewelers and upstart brands are stepping in to nurture the industry, and consumer education will accelerate. Before the cultivation of diamonds into the consumption field, mainly used in industrial production, production enterprises pay more attention to quality and technology, ignoring the importance of brand culture. International brand layouts nurtured the diamond market before domestic brands. Natural diamond miner De beers joined six other leading diamond companies in 2015 to form the Diamond Producers' Association (DPA), a "real is rare, Real is a diamond", to take action against the popularity of synthetic diamonds, but in 2018 it changed its tune. Announced the establishment of the diamond cultivation brand Lightbox to enter the artificial diamond market.

In July of the same year, Swarovski transferred its cultivated diamond brand Diama from the gemstone division to the luxury division, so that it has a higher brand premium. Cultivated diamonds compete with natural diamonds in the high-end market, improving consumers' leapfrog cognition of cultivated diamond image. In the early stage, Diamond Foundry introduced actor Leonardo to participate in the investment, and cooperated with a number of stars to enhance the brand awareness. Established in 2015, Caraxy, a local upstart brand, has appeared in jewelry exhibitions all over the country, causing concern in the industry. Through terminal layout and vigorous promotion, with its industry experience and discourse power, consumer cognition education is under way.

3. Pleasing oneself consumption drives the development of the industry and cultivates diamond multiple attributes to meet rich demand scenarios

Because of its price advantage, the consumption scene of cultivated diamond is more abundant. It can not only be used as a substitute for diamond, but also penetrate the market of fine jewelry and mass jewelry, with practical and fashionable properties. Diamond jewelry is at the higher end of the jewelry market, accounting for 26.25 percent of the total jewelry market with $84 billion in sales in 2021, according to Bain & Company. In 2020, the demand for non-marital diamonds accounted for more than half of the total, reaching 63%. The consumption scenario of diamonds is diversified. In the cultivated diamond market, capacity growth and technological advances in China are leading to lower unit costs and prices. In the future, cultivated diamonds are expected to expand into the mass jewelry sector, while differentiated cultivated diamonds are expected to expand into the fine jewelry sector, making up for the decrease in the supply of natural diamonds.

Personal consumption has become the number one reason to buy diamonds, and the diamond consumption habits of young consumers are helping to foster a new journey in the diamond market. According to Bain Consulting, personal consumption is the top reason for buying diamonds in both China and the United States. In China, it is 46 percent, more than the traditional need for wedding meaning, which accounts for 36 percent and 25 percent, respectively. With the improvement of residents' living standards and the increase of people's willingness to improve their quality of life after the epidemic, cultivated diamond meets the needs of Yuji consumers due to its advantages of high cost performance, fashion and customization. In the future, with the increase of consumption frequency of diamond Yuji and the increase of penetration rate of cultivated diamond, the end-consumption market of cultivated diamond is expected to further expand.

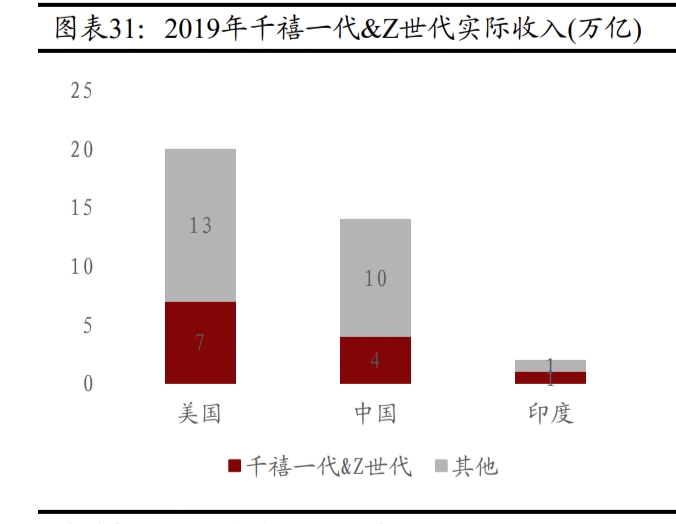

Diamond education has influenced the purchasing preference of the younger generation, and millennials and Generation Z have gradually grown into the main force of diamond consumption. One characteristic attribute of cultivating diamond is its environmental protection. The young generation in the US and India pay more attention to the sustainability of diamond than the old generation. In addition, under the influence of expert opinions and brand media reports, the post-80s generation's daily demand, personalized expression and attention to ESG attribute for diamond jewelry can better represent the consumption trend of jewelry. The advantages of high-quality, inexpensive, colorful and customized diamonds are in line with the consumption concept, purchasing habits and lifestyle of the young generation. According to Bain data, the real income of millennials and Generation Z is expected to increase significantly in 2030, doubling from 2019, accounting for more than 50% of all income groups, and the majority of diamond consumption is expected to gradually switch to the younger generation.

4. It is estimated that the sales CAGR of China's cultivated diamond retail market will reach 27% during 2022-2025, and the penetration rate of cultivated diamond will increase to 17%

Basic assumption:

1) Diamond terminal sales: According to Bain's data, the global diamond jewelry consumption market maintained a stable development from 2013 to 2019, with a steady annual growth rate of 0-2.8%. Due to the impact of the epidemic in 2020, the diamond sales decreased significantly in 2021, with a year-on-year growth of 29%. The sales volume increased significantly and exceeded that of 2019. We estimate that the annual market growth rate of global diamond sales in 2022-2025 will be 2%-3%, which will return to the original growth level, and the annual market growth rate of the US will be 3%-4%. China's market is growing at an average annual rate of 2.5-3%.

2) Cultivated diamond permeability: According to data from Chindot Finance and Bain Consulting, the global cultivated diamond penetration rate will increase from 5.9% to 8% in 2020-2021. Assuming an annual increase of 2 PCTS in the future, the global cultivated diamond penetration rate is expected to reach 16% by 2025; In 2020-2021, the penetration rate of cultivated drilling in China increased from 4.0% to 6.7%. Assuming an increase of 2-3 PCTS per year, the penetration rate of cultivated drilling in China is expected to reach 17.0% by 2025.

3) Cultivate diamond sales market: Cultivate diamond terminal sales = diamond terminal sales * Cultivate diamond permeability. According to Diamond Observation data, the gross profit rate of cultivated diamond retail is between 55%-65%. It is estimated that cultivated diamond naked diamond: the terminal retail price =1:3, then the market sales of cultivated diamond naked diamond = 1/3 of the terminal sales of cultivated diamond. To sum up, we expect global sales of cultivated diamond terminals to be $14.9 billion by 2025, with a CAGR of 19.88% from 2022 to 2025; The consumption amount of cultivated diamond jewelry in China is 1.5 billion US dollars, with a CAGR of 26.91% from 2022 to 2025.